A Cube of Calamity: The Quadrants and Detectability

In addition to the two dimensions of likelihood and impacts, disruptions vary on a third crucial dimension: detectability. Some types of disruptions can be forecasted or detected well before they have an impact on the enterprise, while others hit without warning. Detectability adds a time dimension to the classification of disruptions and is defined as the time between knowing that a disruptive event will take place and the first impact. Note that the detectability of an event can be positive (detection before the impact), zero (realization at the instant of occurrence), or even negative (detection after the disruption has taken place).

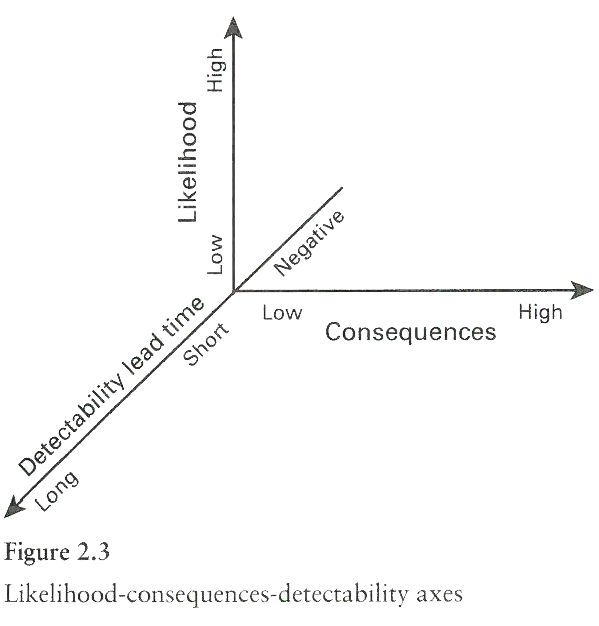

Figure 2.3 shows the addition of the detectability dimension to the two dimensions depicted in the quadrant diagram in figure 2.1. The detectability axis can be divided into four main segments: very long-term trends that are well discussed in the media, for which companies have time to prepare strategically; disruptions that arise and hit after some short warning (e.g., hurricanes); disruptions that strike with no warning but can be instantly recognized if they happen (e.g., a fire); and disruptions that are hidden and are only discovered some time after the fact (e.g., a product contamination or design defect) or not at all (e.g., industrial espionage).

Forewarned Is Forearmed: Positive Detection Lead-Time

Trends such as the aging of the world's population in the Western world, China, and Japan, come as no surprise and can be detected years—even decades—in advance. Growing demand for the energy and natural resources in China, India, and other emerging markets is also all but inevitable, with its concomitant implications for supplies and prices. Long-term trends in urbanization, mobile phone usage, economic growth in sub-Saharan Africa, robotics (including drones), rising food prices, and water scarcity will affect investments and supply chain patterns. The difference between long-term trends and any other risk is that these trends offer an opportunity to incorporate them into a company's strategy, thereby profiting from them. Nonetheless, like the proverbial frog in gradually heating water, some companies may not detect, prepare for, or take advantage of slowly shifting trends.

The end dates of labor contracts are known on the signing date of the contract, yet some companies miss that signal of higher risk of labor strikes at that time. The phase-in dates of major regulatory changes (e.g., regarding toxic chemicals) can likewise have months or years of lead time. Most supplier bankruptcies should be of little surprise (see chapter 5). Companies can detect which suppliers have precarious balance sheets, unfavorable patterns of profits, or negative cash flows months before the supplier reaches a point of insolvency or bankruptcy. Furthermore, shipment errors, quality problems, and slow refunds can presage a troubled supplier even before this shows in the financial data.

Other threats have shorter detection horizons but still offer some chance of a warning. As capricious as the weather seems, the physics of moist air flowing at various altitudes and at various temperatures isn't impenetrably mysterious. Hurricanes, many floods, and winter storms now arrive with hours or days of warning. When a hurricane steams into the Gulf of Mexico, the oil rig workers know what to do. They are trained to carry out a series of "shut-in" procedures for closing key valves and securing equipment, thereby reducing the chances of an oil spill when the storm hits and enabling a rapid restart after the storm passes. Forewarning lets a company kick-off impact-avoidance and recovery efforts.

Even earthquakes can be detected as they start, enabling early warnings to those more distant from the epicenter. Businesses and residents of Tokyo knew the 2011 quake was coming about 80 seconds before it struck and had up to 40 minutes of the tsunami's arrival in Tokyo Bay. Data can now flow faster than disaster (see chapter 8).

BANG! Hit in an Instant: Zero Detection Lead-Time

On the morning of December 8, 2010, the electricity supply dropped for just 0.07 of a second at Toshiba's Yokkaichi memory-chip plant in Mie prefecture. The power glitch caused the factory's equipment to reboot, which ruined all the wafers in production. That was all it took to create a two-month disruption in production of NAND flash memory. At the time, Toshiba provided 35.4 percent of the world's supply of NAND flash, and the failure affected about 20 percent of Toshiba's production. "I don't think it could come at a worse time," said Krishna Shankar, an analyst at ThinkEquity, because of the surging demand for NAND flash in fast-growing product categories such as smartphones, tablets, digital cameras, and music players. No one could have forecast the event. Toshiba had no warning of the disruption, but it did know in an instant that disruption had struck.

Some events strike with little or no warning, like a technology outage, an explosion in a factory, or a terrorist attack. One minute, everything is running smoothly and, the next second, chaos erupts. What happens afterward is depends on the likelihood of the event. High-impact/high-likelihood disruptions that strike suddenly trigger a playbook response based on experience and drills. High-impact/low-likelihood disruptions that strike suddenly trigger a playbook response based on experience and drills. High-impact/low-likelihood events are more of a surprise and require significant information gathering, assessment, and creative problem solving.

In both cases, the detection time includes the time required for the company to sufficiently understand what happened and to mount an appropriate response. During 9/11, for example, the first plane to hit the World Trade Center was presumed to be an accident. Only after the second plane hit and after enough of the US government's agencies realized what was happening, was the military able to launch jets to intercept United Flight 93, which crashed in western Pennsylvania before the military could intercept it. A large disruption can affect an entire industry, in which case the company that identifies the nature and magnitude of the problem early on can minimize the impact by securing supply, transportation, and access before its competitors do.

Lurking Danger in Hidden Events: Negative Detection Lead-Time

In early 2007, a long-term paint supplier to Mattel ran short of colorants for the paint and could not get more from its primary supplier. The supplier quickly found a backup supplier via the Internet, who assured that it could supply safe colorants that were certified as lead-free. The paint supplier didn't test the new colorant because testing would delay production, although paint workers noted that the new paint did not smell the same as the usual formulation. For two and half months, Mattel's contract manufacturer made and shipped some one million toys painted with the substitute colorants. The toys flowed from Cina across the seas to distributors and retailers. In early July 2007, testing by a European retailer revealed prohibited levels of lead in the paint and coatings on some Mattel toys. Mattel immediately halted production of the toys, investigated the cause, and confirmed the presence of lead in the paint. In early August of 2007, Mattel recalled nearly one million toys of 83 different types.

Fortunately, the impact was not as bad as it could have been because two-thirds of the contaminated toys were still in the distribution chain. Yet Mattel still needed to alert consumers to return some 300,000 sold toys made during the two-and-a-half month period before it realized the problem. Subsequent testing found other lead-contaminated toys, which forced Mattel to recall another million toys that autumn. Mattel also paid a $2.3 million fine for violating federal bans on lead paint. The recall meant that Mattel had to incur significant costs, including the logistics of identifying, collecting, and destroying the toxic products. More important, the incident tainted the brand in the eyes of consumers and the media. As a result, Mattel's stock fell 25 percent off its 2007 high during the worst of the recall incident.

Whereas everyone knows when an earthquake hits, some disasters have a hidden start. Food contamination incidents can take weeks to surface as a result of delays in the food reaching consumers, the incubation time of the food-borne pathogens, and the time required to trace the illness back to particular types and brands of food. Usually, the greater the delay in detecting a hidden problem, the greater the impact and the resulting damage. Product defects—caused by design errors or material quality issues—may not surface until long after the goods are in customers' hands and in use.

Some disruptions have a more insidious and less detectable character—they are unknown unknowns. For example, toys have contained magnets for decades without safety concerns, but a new breed of high-strength magnets created an unforeseen and serious safety problem. Unline prior generations of magnets, if these types of high-strength magnets broke loose from the toy and if a child swallowed more than one magnet over time, then the magnets could potentially pinch together two parts of the child's intestines, cause a perforation, and lead to a serious infection. Toy makers sold tens of millions of toys with these types of magnets over a nine-year period before health and safety officials detected the problem and mandated an expensive recall.

Excerpt from The Power of Resilience: How the Best Companies Manage the Unexpected by Yossi Sheffi (MIT Press, 2015)